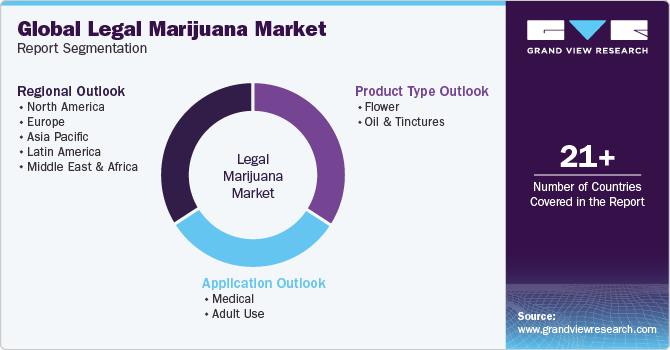

Legal Marijuana Market Size, Share & Trends Analysis Report By Application (Medical, Adult Use), By Product Type (Flower, Oils and Tinctures), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-152-8

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Legal Marijuana Market Size & Trends

The global legal marijuana market size was valued at USD 21.0 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 25.7% from 2024 to 2030. Increasing demand for legal marijuana is a major factor in growth of the market. Recently, many countries have legalized the use of medical marijuana for treating various conditions. For instance, in June 2023, Luxembourg legalized possession and cultivation of cannabis for recreational use and became the second European Union member country to legalize it. In addition, North America (the U.S. and Canada) has gone a step further and has sanctioned the use of recreational marijuana as well. More than two-thirds of the U.S. states have legalized marijuana. The industry is experiencing growth owing to growing awareness regarding various therapeutic benefits of the product, such as reducing eye pressure, appetite enhancement, and pain management.

Several studies have shown that medical marijuana and its derivatives can be used to treat symptoms of various diseases. For instance, according to articles published by the National Center for Biotechnology Information (NCBI), cannabis has been successfully used to treat patients with chemotherapy-induced nausea, chronic pain, Alzheimer’s, Parkinson’s, and other neurological diseases. Furthermore, the FDA and other such associations have now started accepting marijuana derivatives for the prescription of diseases, which has proven to be useful. For instance, the FDA has approved the cannabinoids cannabidiol (Epidiolex) for certain forms of severe epilepsy and dronabinol (Marinol, Syndros) for nausea and vomiting caused by cancer chemotherapy. This is another factor that drives the market growth.

With a changing government policy, the demand for medical marijuana is also increasing. A lot of countries that have legalized the use of medical marijuana are also paving the way for its cultivation to cut imports and earn revenue in the form of taxes. This, in turn, has generated industry jobs, and many more companies are dabbling in this industry. For instance, in the Netherlands, marijuana is a big business, and annually, the Dutch government earns 400 million euros (USD 437.96 million) in taxes from the nation's 730 marijuana-selling coffee shops.

Several startups in the U.S. and Europe are now focusing on alternate uses of cannabis other than recreational and medicinal. With so much happening in and around the cannabis industries, the countries are paving way for more liberal policies regarding its cultivation and usage in the medical field as well as industrial use. For instance, Sanity Group, a Berlin-based Startup founded in 2018, offers Vayamed and AVAAY Medical (medicinal cannabis) and Endosane Pharmaceuticals (finished cannabis pharmaceuticals).

A growing number of cultivators for cannabis, including marijuana, since this rakes in more revenues for the various governments. Since being legalized, its sales have increased exponentially, leading to diverse applications across various industries, from medical to industrial, which has generated new opportunities to increase revenues. For instance, the sales of medical and non-medical based cannabis in Canada is as follows,

Table 1 Total Medical And Non-Medical Sales In Packaged Units In Canada

|

Cannabis product type |

Total medical and non-medical sales (units) |

Percentage share of total sales |

|

Dried cannabis |

10,634,524 |

53% |

|

Edible cannabis |

4,416,270 |

22% |

|

Cannabis Extracts |

4,907,319 |

24% |

|

Seeds |

5,552 |

<0.1% |

|

Topicals |

76,564 |

0.3% |

|

Vegetative cannabis plant |

10,278 |

<0.1% |

With the FDA-level authorizations underway, the market for legal marijuana is only going to expand. A large number of clinical trials are anticipated to support marijuana derivatives for it to be legally prescribed for indications. For instance, in October 2023, Avextra Pharma GmbH announced the new double-blind Phase 2 clinical trial for the use of cannabis in the treatment of cancer patients in palliative care.

Market Concentration & Characteristics

The market growth stage is high, and pace of the market growth is accelerating. The legal marijuana market is characterized by a moderate-to-high degree of growth owing to rising investment in R&D programs and increased demand for cannabis-containing vapes, pre-rolls, and gummies. For instance, the Philadelphia College of Osteopathic Medicine (PCOM) conducts medical marijuana research to assess the impact of medical cannabis on behavior, quality of life, chronic pain, and more .

The market is characterized by a high degree of innovation owing to ongoing clinical trials on the use of cannabis and its medicinal properties, increasing product demand due to its health benefits, and growing preference for cannabis extracts such as oils and tinctures. For instance, in November 2023, a Tasmanian medicinal cannabis farm tripled its production as demand for cannabis-based products increased.

The market is also characterized by a medium level of merger and acquisition (M&A) activity by the leading players. Through M&A activity, these companies can expand their product portfolio, enter new territories, and strengthen their market position. For instance, in May 2022, Canopy Growth Corporation entered into definitive agreements to acquire Lemurian, Inc., a producer of high-quality cannabis extracts, to broaden Canopy Growth’s portfolio of premium brands with significant opportunities to scale across North America.

The global market for legal marijuana is flourishing owing to the increasing number of countries legalizing and providing a systematic regulatory framework for the cultivation and sale of cannabis. For instance, in Asia, in February 2021, Thailand became the first country to legalize the use and purchase of cannabis leaves. Later, in June 2022, the legalization was extended to the whole plant, following the 2019 allowance for medical purposes. Thus, increased legalization for cannabis boosts the market growth.

Many companies are adopting various strategies, which include collaboration, product expansion, and partnerships, to strengthen their market position. For instance, in October 2023, Cantourage Group SE, a producer and distributor of medical cannabis, launched a range of high-THC medicinal cannabis flowers in Switzerland in collaboration with Astrasana.

The popularity of cannabis-containing foods and the legalization of cannabis is rapidly rising due to the various health benefits associated with cannabis. Due to legalization, many market players are expanding their market presence in such areas. For instance, in October 2022, Canopy Growth Corporation, a Canadian-based cannabis company, sped up its entry into the U.S. cannabis market with a new holding company, i.e., Canopy USA. This move allowed Canopy Growth Corporation to complete its acquisition of California extracts maker Jetty, Colorado-based edibles specialist Wana Brands, and New York-based Acreage Holdings.

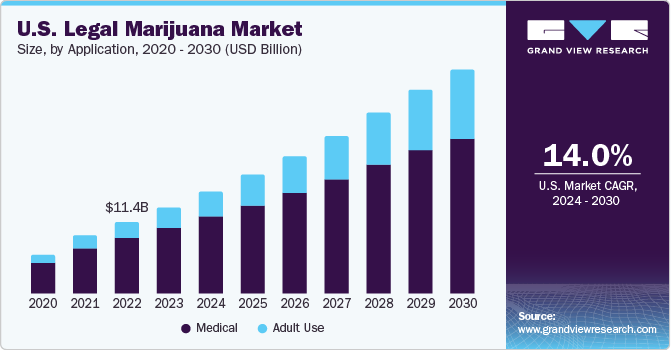

Application Insights

By application, market is segmented into medical and adult use. The medical segment led the market and accounted for 79.1% of the global revenue in 2023. Factors such as recent legalization and decriminalization of marijuana for medical use attributed to growth of this segment. Patients in these geographic regions have been seen preferring the medical use of marijuana due to the ease of availability and economical pricing. For instance, according to the National Conference of State Legislatures, as of April 2023, in the U.S., cannabis products were legalized in 38 states, three territories, and the District of Columbia for medical use.

Furthermore, cannabis derivatives have been extensively studied for their potency as an analgesic. It has shown far better results with fewer side effects than the regular medicines being prescribed till now. It has been proven to reduce arthritic pain significantly with negligible side effects. For instance, according to a study published in Jama Network Open in 2023, more than half of adults (948 out of 1661) used cannabis to manage their chronic pain. With an increase in awareness surrounding the use of medical cannabis and its derivatives, the market is expected to grow over the forecast period.

Adult-use segment is expected to witness fastest CAGR growth over the forecast period. In countries like the U.S. and Canada, where adult-use and medical-use cannabis have both been legalized, people are still preferring adult-use marijuana due to the lack of reimbursements available for medical marijuana. For instance, according to the National Conference of State Legislatures, as of November 2023, in the U.S., 24 states, two territories, and the District of Columbia have enacted guidelines to regulate cannabis for adult or recreational use. Moreover, changing consumer behavior toward recreational marijuana is another factor anticipated to boost segment growth.

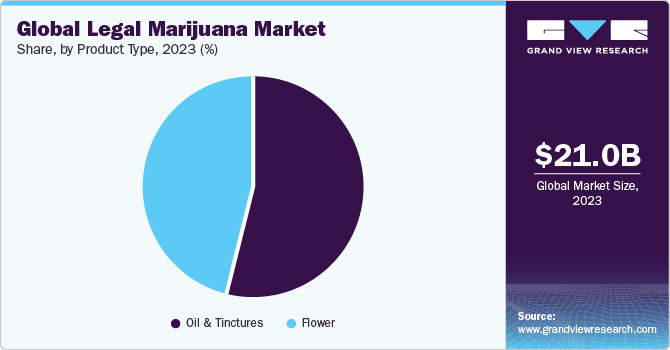

Product Type Insights

By product type, market is divided into oil & tinctures and flowers. Oil and tinctures segment accounted for largest market revenue share in 2023. Marijuana oil and tinctures are being studied extensively for multiple indications in a lot of countries. Oils extracted from cannabis are utilized for the treatment of nausea and vomiting caused due to cancer. Furthermore, rising introduction of cannabis-based products for medical use drives the market growth. For instance, in May 2023, Stenocare received approval from the Federal Institute for Drugs and Medical Devices (BfArM) for its medical cannabis oil for prescription-based sales to German patients.

In addition, oil and tinctures are anticipated to register the fastest growth rate over the forecast period. Cannabinoids that are present in the oil help in improving sleep disorders and alleviate anxiety and stress. For instance, according to an article published in NCBI, preliminary research on insomnia and cannabis suggested that cannabidiol (CBD) may have therapeutic potential for the treatment of insomnia. The demand for oils and tinctures is anticipated to increase over the forecast period owing to a substantial increase in patients preferring oil compared to flowers. Moreover, children who need cannabis derivatives for their treatment cannot be suggested to use flowers to smoke and are instead being prescribed oils and tinctures due to the respiratory problems caused by smoking flowers.

Regional Insights

North America dominated the market with a revenue share of 76.0% in 2023. The rapid increase in the rate at which the government is decriminalizing cannabis for both medical and adult use or recreational use of marijuana is a key factor driving the regional market. The presence of majority of market players in the cannabis market and structured regulatory framework further strengthens this position. For instance, in February 2023, the FDA issued guidance on cannabis and cannabis-derived compounds, specifically for the development of drugs for human use. With more than two-thirds of the U.S. falling under the legal territory for cannabis, the demand and supply both have increased, which is further boosting North America’s position as the forerunner.

Several countries are legalizing cannabis in the Asia Pacific region, and growing cannabis research programs boost the market growth. For instance, in July 2023, the 'Cannabis Research Project' at CSIR-IIIM Jammu was established in India through a Canadian company and government partnership. This project has the potential to benefit people by exploring the use of cannabis to treat conditions such as epilepsy, neuropathies, and cance. Due to clinical studies confirming its effectiveness as a pain reliever, countries with a significant elderly population are expected to accelerate the legalization process, which can spur the industry's growth in the region.

Key Companies & Market Share Insights

Some of the key players operating in the market include Canopy Growth Corporation, AURORA CANNABIS INC., Tilray Brands Inc. (Aphria, Inc.), and The Cronos Group. Lexaria Bioscience, Organigram Holdings Inc., and MARICANN INC., are some of the emerging market participants in the legal marijuana market.

-

Canopy Growth Corporation is a one of the leading producer and distributor of medical cannabis. The company offers a range of brands in Canada, the U.S., and across the globe. Some of its brands in Canada are Tweed, DOJA, Quatreau, and Deep Space, and in the U.S. are CBD & Quatreau. The company is focusing on their innovation and R&D capabilities and introducing innovative edibles and beverages.

-

AURORA CANNABIS INC. is a producer and distributor of dried cannabis and cannabis oil. The company has a presence in more than 20 countries. It has entered into strategic agreements with various companies, catering to industry verticals such as pharmaceuticals, food & beverages, and others for its cannabis supply.

-

Organigram Holdings Inc. produces and markets medical cannabis within Canada. Some of the company's key brands include Banook, Rossignol, Shubie, and Utopia.

Key Legal Marijuana Companies:

- Canopy Growth Corporation

- AURORA CANNABIS INC.

- Tilray Brands Inc. (Aphria, Inc.)

- ABcann Medicinals, Inc. (VIVO Cannabis Inc.)

- The Cronos Group

- MARICANN INC.

- Organigram Holdings Inc.

- Lexaria Bioscience

- GW Pharmaceuticals (Jazz Pharmaceuticals, Inc.)

- Tikun Olam

- United Cannabis Corporation

Recent Developments

-

In January 2024, Village Farms International, Inc., announced the launch of two cannabis brands in the UK, such as Pure Sunfarms and The Original Fraser Valley Weed Co. (Fraser Valley). 4C LABS, a UK-based medical cannabis company, will distribute these brands.

-

In March 2023, Canopy Growth introduced six new beverage flavors. Under the Deep Space brand, the company announced Canada's first cannabis-infused beverage with naturally occurring caffeine. The company also launched four flavors under the Tweed brand for springtime.

Legal Marijuana Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 26.0 billion |

|

Revenue forecast in 2030 |

USD 102.2 billion |

|

Growth rate |

CAGR of 25.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast data |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/ billion & CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, application |

|

Regions covered |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; U.K.; Germany; Italy; Netherlands; Spain; Croatia; Poland; Czech Republic; Switzerland; Japan; China; India; New Zealand; Australia, Thailand; Brazil; Mexico; Colombia; Uruguay; South Africa, Israel |

|

Key companies profiled |

Canopy Growth Corporation; AURORA CANNABIS INC.; Tilray Brands Inc. (Aphria, Inc.); ABcann Medicinals, Inc. (VIVO Cannabis Inc.); The Cronos Group; MARICANN INC. Organigram Holdings Inc.; Lexaria Bioscience; GW Pharmaceuticals (Jazz Pharmaceuticals, Inc.); Tikun Olam; United Cannabis Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Legal Marijuana Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global legal marijuana market report based on application, product type and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical

-

Chronic Pain

-

Cancer

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s

-

Post-traumatic Stress Disorder (PTSD)

-

Parkinson's

-

Tourette’s

-

Others

-

-

Adult Use

-

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Flower

-

Oil & Tinctures

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Netherlands

-

Croatia

-

Poland

-

Czech Republic

-

Switzerland

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

New Zealand

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Uruguay

-

Colombia

-

-

Middle East & Africa (MEA)

-

South Africa

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global legal marijuana market size was estimated at USD 21.0 billion in 2023 and is expected to reach USD 26.00 billion in 2024.

b. The global legal marijuana market is expected to grow at a compound annual growth rate of 25.7% from 2024 to 2030 to reach USD 102.2 billion by 2030.

b. The medical-use segment dominated the legal marijuana market with a revenue share of 79.1% in 2023 and is expected to witness significant growth from 2023 to 2030.

b. The oil and tinctures segment dominated the legal marijuana market in 2023 with a revenue share of 54.2%.

b. The chronic pain segment dominated the legal marijuana market in 2023 with a share of 26.2%.

Table of Contents

Chapter 1. Legal Marijuana Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Application

1.2.2. Product Type

1.2.3. Regional scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Legal Marijuana Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Application outlook

2.2.2. Product type outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Legal Marijuana Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Growing adoption of medical marijuana for treatment of chronic diseases

3.2.1.2. Growing legalization of medical marijuana in various countries

3.2.1.3. Elimination of black market through legalization of medical marijuana

3.2.1.4. Impending legalization of marijuana for recreational/adult use

3.2.2. Market restraint analysis

3.2.2.1. Lower market access of marijuana due to absence of legalization programs in several Asian and African countries

3.2.2.2. Legalization of medical marijuana only for selected indications

3.2.2.3. Supply shortage of medical marijuana in various countries

3.3. Legal Marijuana Market Analysis Tools

3.3.1. Industry Analysis – Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. Legal Marijuana Market: Application Estimates & Trend Analysis

4.1. Application Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Legal Marijuana Market by Application Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Medical

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2. Cancer

4.4.1.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.3. Chronic Pain

4.4.1.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4. Depression and Anxiety

4.4.1.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.5. Arthritis

4.4.1.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6. Diabetes

4.4.1.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.7. Glaucoma

4.4.1.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.8. Migraines

4.4.1.8.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.9. Epilepsy

4.4.1.9.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.10. Multiple Sclerosis

4.4.1.10.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.11. AIDS

4.4.1.11.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.12. Amyotrophic Lateral Sclerosis

4.4.1.12.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.13. Alzheimer’s

4.4.1.13.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.14. Post-Traumatic Stress Disorder (PTSD)

4.4.1.14.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.15. Parkinson's

4.4.1.15.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.16. Tourette’s

4.4.1.16.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.17. Others

4.4.1.17.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2. Adult Use

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 5. Legal Marijuana Market: Product Type Estimates & Trend Analysis

5.1. Product Type Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Legal Marijuana Market by Product Type Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Flower

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2. Oil and tinctures

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 6. Legal Marijuana Market: Regional Estimates & Trend Analysis

6.1. Regional Market Share Analysis, 2023 & 2030

6.2. Regional Market Dashboard

6.3. Global Regional Market Snapshot

6.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

6.5. North America

6.5.1. U.S.

6.5.1.1. Key country dynamics

6.5.1.2. Regulatory framework/ reimbursement structure

6.5.1.3. Competitive scenario

6.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Million)

6.5.2. Canada

6.5.2.1. Key country dynamics

6.5.2.2. Regulatory framework/ reimbursement structure

6.5.2.3. Competitive scenario

6.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

6.6. Europe

6.6.1. UK

6.6.1.1. Key country dynamics

6.6.1.2. Regulatory framework/ reimbursement structure

6.6.1.3. Competitive scenario

6.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

6.6.2. Germany

6.6.2.1. Key country dynamics

6.6.2.2. Regulatory framework/ reimbursement structure

6.6.2.3. Competitive scenario

6.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Million)

6.6.3. Netherlands

6.6.3.1. Key country dynamics

6.6.3.2. Regulatory framework/ reimbursement structure

6.6.3.3. Competitive scenario

6.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Million)

6.6.4. Italy

6.6.4.1. Key country dynamics

6.6.4.2. Regulatory framework/ reimbursement structure

6.6.4.3. Competitive scenario

6.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Million)

6.6.5. Spain

6.6.5.1. Key country dynamics

6.6.5.2. Regulatory framework/ reimbursement structure

6.6.5.3. Competitive scenario

6.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Million)

6.6.6. Croatia

6.6.6.1. Key country dynamics

6.6.6.2. Regulatory framework/ reimbursement structure

6.6.6.3. Competitive scenario

6.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Million)

6.6.7. Poland

6.6.7.1. Key country dynamics

6.6.7.2. Regulatory framework/ reimbursement structure

6.6.7.3. Competitive scenario

6.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Million)

6.6.8. Czech Republic

6.6.8.1. Key country dynamics

6.6.8.2. Regulatory framework/ reimbursement structure

6.6.8.3. Competitive scenario

6.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

6.6.9. Switzerland

6.6.9.1. Key country dynamics

6.6.9.2. Regulatory framework/ reimbursement structure

6.6.9.3. Competitive scenario

6.6.9.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

6.7. Asia Pacific

6.7.1. Japan

6.7.1.1. Key country dynamics

6.7.1.2. Regulatory framework/ reimbursement structure

6.7.1.3. Competitive scenario

6.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Million)

6.7.2. China

6.7.2.1. Key country dynamics

6.7.2.2. Regulatory framework/ reimbursement structure

6.7.2.3. Competitive scenario

6.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Million)

6.7.3. India

6.7.3.1. Key country dynamics

6.7.3.2. Regulatory framework/ reimbursement structure

6.7.3.3. Competitive scenario

6.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Million)

6.7.4. Australia

6.7.4.1. Key country dynamics

6.7.4.2. Regulatory framework/ reimbursement structure

6.7.4.3. Competitive scenario

6.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Million)

6.7.5. New Zealand

6.7.5.1. Key country dynamics

6.7.5.2. Regulatory framework/ reimbursement structure

6.7.5.3. Competitive scenario

6.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Million)

6.7.6. Thailand

6.7.6.1. Key country dynamics

6.7.6.2. Regulatory framework/ reimbursement structure

6.7.6.3. Competitive scenario

6.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Million)

6.8. Latin America

6.8.1. Brazil

6.8.1.1. Key country dynamics

6.8.1.2. Regulatory framework/ reimbursement structure

6.8.1.3. Competitive scenario

6.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Million)

6.8.2. Mexico

6.8.2.1. Key country dynamics

6.8.2.2. Regulatory framework/ reimbursement structure

6.8.2.3. Competitive scenario

6.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Million)

6.8.3. Colombia

6.8.3.1. Key country dynamics

6.8.3.2. Regulatory framework/ reimbursement structure

6.8.3.3. Competitive scenario

6.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

6.8.4. Colombia

6.8.4.1. Key country dynamics

6.8.4.2. Regulatory framework/ reimbursement structure

6.8.4.3. Competitive scenario

6.8.4.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

6.9. MEA

6.9.1. South Africa

6.9.1.1. Key country dynamics

6.9.1.2. Regulatory framework/ reimbursement structure

6.9.1.3. Competitive scenario

6.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

6.9.2. Isarel

6.9.2.1. Key country dynamics

6.9.2.2. Regulatory framework/ reimbursement structure

6.9.2.3. Competitive scenario

6.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company market share analysis, 2023

7.3.4. Canopy Growth Corporation

7.3.4.1. Company overview

7.3.4.2. Financial performance

7.3.4.3. Product benchmarking

7.3.4.4. Strategic initiatives

7.3.5. AURORA CANNABIS INC.

7.3.5.1. Company overview

7.3.5.2. Financial performance

7.3.5.3. Product benchmarking

7.3.5.4. Strategic initiatives

7.3.6. Tilray Brands Inc. (Aphria, Inc.)

7.3.6.1. Company overview

7.3.6.2. Financial performance

7.3.6.3. Product benchmarking

7.3.6.4. Strategic initiatives

7.3.7. ABcann Medicinals, Inc. (VIVO Cannabis Inc.)

7.3.7.1. Company overview

7.3.7.2. Financial performance

7.3.7.3. Product benchmarking

7.3.7.4. Strategic initiatives

7.3.8. The Cronos Group

7.3.8.1. Company overview

7.3.8.2. Financial performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. MARICANN INC.

7.3.9.1. Company overview

7.3.9.2. Financial performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. Organigram Holdings Inc.

7.3.10.1. Company overview

7.3.10.2. Financial performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. Lexaria Bioscience

7.3.11.1. Company overview

7.3.11.2. Financial performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives

7.3.12. GW Pharmaceuticals (Jazz Pharmaceuticals, Inc.)

7.3.12.1. Company overview

7.3.12.2. Financial performance

7.3.12.3. Product benchmarking

7.3.12.4. Strategic initiatives

7.3.13. Tikun Olam

7.3.13.1. Company overview

7.3.13.2. Financial performance

7.3.13.3. Product benchmarking

7.3.13.4. Strategic initiatives

7.3.14. United Cannabis Corporation

7.3.14.1. Company overview

7.3.14.2. Financial performance

7.3.14.3. Product benchmarking

7.3.14.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America legal marijuana market, by region, 2018 - 2030 (USD Million)

Table 3 North America legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 4 North America legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 5 U.S. legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 6 U.S. legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 7 Canada legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 8 Canada legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 9 Europe legal marijuana market, by region, 2018 - 2030 (USD Million)

Table 10 Europe legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 11 Europe legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 12 Germany legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 13 Germany legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 14 UK legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 15 UK legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 16 Netherlands legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 17 Netherlands legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 18 Italy legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 19 Italy legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 20 Spain legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 21 Spain legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 22 Croatia legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 23 Croatia legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 24 Poland legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 25 Poland legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 26 Czech Republic legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 27 Czech Republic legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 28 Switzerland legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 29 Switzerland legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 30 Asia Pacific legal marijuana market, by region, 2018 - 2030 (USD Million)

Table 31 Asia Pacific legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 32 Asia Pacific legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 33 China legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 34 China legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 35 Japan legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 36 Japan legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 37 India legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 38 India legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 39 New Zealand legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 40 New Zealand legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 41 Australia legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 42 Australia legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 43 Thailand legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 44 Thailand legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 45 Latin America legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 46 Latin America legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 47 Latin America legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 48 Brazil legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 49 Brazil legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 50 Mexico legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 51 Mexico legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 52 Uruguay legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 53 Uruguay legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 54 Colombia legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 55 Colombia legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 56 MEA legal marijuana market, by region, 2018 - 2030 (USD Million)

Table 57 MEA legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 58 MEA legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 59 South Africa legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 60 South Africa legal marijuana market, by product type, 2018 - 2030 (USD Million)

Table 61 Israel legal marijuana market, by application, 2018 - 2030 (USD Million)

Table 62 Israel legal marijuana market, by product type, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Legal marijuana market: market outlook

Fig. 9 Legal marijuana competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 Legal marijuana market driver impact

Fig. 15 Legal marijuana market restraint impact

Fig. 16 Legal marijuana market strategic initiatives analysis

Fig. 17 Legal marijuana market: Application movement analysis

Fig. 18 Legal marijuana market: Application outlook and key takeaways

Fig. 19 Medical market estimates and forecast, 2018 - 2030

Fig. 20 Chronic Pain market estimates and forecast, 2018 - 2030

Fig. 21 Cryoablation market estimates and forecast, 2018 - 2030

Fig. 22 Cancer market estimates and forecast, 2018 - 2030

Fig. 23 Depression and Anxiety market estimates and forecast, 2018 - 2030

Fig. 24 Arthritis market estimates and forecast, 2018 - 2030

Fig. 25 Diabetes market estimates and forecast, 2018 - 2030

Fig. 26 Glaucoma market estimates and forecast, 2018 - 2030

Fig. 27 Migraines market estimates and forecast, 2018 - 2030

Fig. 28 Epilepsy market estimates and forecast, 2018 - 2030

Fig. 29 Multiple Sclerosis market estimates and forecast, 2018 - 2030

Fig. 30 AIDS market estimates and forecast, 2018 - 2030

Fig. 31 Amyotrophic Lateral Sclerosis market estimates and forecast, 2018 - 2030

Fig. 32 Post-traumatic Stress Disorder (PTSD) market estimates and forecast, 2018 - 2030

Fig. 33 Parkinson's market estimates and forecast, 2018 - 2030

Fig. 34 Tourette’s market estimates and forecast, 2018 - 2030

Fig. 35 Others market estimates and forecast, 2018 - 2030

Fig. 36 Adult Use market estimates and forecast, 2018 - 2030

Fig. 37 Legal marijuana Market: Product Type movement Analysis

Fig. 38 Legal marijuana market: Product Type outlook and key takeaways

Fig. 39 Flower market estimates and forecasts, 2018 - 2030

Fig. 40 Oil and Tinctures market estimates and forecasts, 2018 - 2030

Fig. 41 Global Legal marijuana market: Regional movement analysis

Fig. 42 Global Legal marijuana market: Regional outlook and key takeaways

Fig. 43 Global Legal marijuana market share and leading players

Fig. 44 North America market share and leading players

Fig. 45 Europe market share and leading players

Fig. 46 Asia Pacific market share and leading players

Fig. 47 Latin America market share and leading players

Fig. 48 Middle East & Africa market share and leading players

Fig. 49 North America, by country

Fig. 50 North America

Fig. 51 North America market estimates and forecasts, 2018 - 2030

Fig. 52 U.S.

Fig. 53 U.S. market estimates and forecasts, 2018 - 2030

Fig. 54 Canada

Fig. 55 Canada market estimates and forecasts, 2018 - 2030

Fig. 56 Europe

Fig. 57 Europe market estimates and forecasts, 2018 - 2030

Fig. 58 UK

Fig. 59 UK market estimates and forecasts, 2018 - 2030

Fig. 60 Germany

Fig. 61 Germany market estimates and forecasts, 2018 - 2030

Fig. 62 Netherlands

Fig. 63 Netherlands market estimates and forecasts, 2018 - 2030

Fig. 64 Italy

Fig. 65 Italy market estimates and forecasts, 2018 - 2030

Fig. 66 Spain

Fig. 67 Spain market estimates and forecasts, 2018 - 2030

Fig. 68 Croatia

Fig. 69 Croatia market estimates and forecasts, 2018 - 2030

Fig. 70 Poland

Fig. 71 Poland market estimates and forecasts, 2018 - 2030

Fig. 72 Czech Republic

Fig. 73 Czech Republic market estimates and forecasts, 2018 - 2030

Fig. 74 Switzerland

Fig. 75 Switzerland market estimates and forecasts, 2018 - 2030

Fig. 76 Asia Pacific

Fig. 77 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 78 China

Fig. 79 China market estimates and forecasts, 2018 - 2030

Fig. 80 Japan

Fig. 81 Japan market estimates and forecasts, 2018 - 2030

Fig. 82 India

Fig. 83 India market estimates and forecasts, 2018 - 2030

Fig. 84 Thailand

Fig. 85 Thailand market estimates and forecasts, 2018 - 2030

Fig. 86 New Zealand

Fig. 87 New Zealand market estimates and forecasts, 2018 - 2030

Fig. 88 Australia

Fig. 89 Australia market estimates and forecasts, 2018 - 2030

Fig. 90 Latin America

Fig. 91 Latin America market estimates and forecasts, 2018 - 2030

Fig. 92 Brazil

Fig. 93 Brazil market estimates and forecasts, 2018 - 2030

Fig. 94 Mexico

Fig. 95 Mexico market estimates and forecasts, 2018 - 2030

Fig. 96 Colombia

Fig. 97 Colombia market estimates and forecasts, 2018 - 2030

Fig. 98 Uruguay

Fig. 99 Uruguay market estimates and forecasts, 2018 - 2030

Fig. 100 Middle East and Africa

Fig. 101 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 102 South Africa

Fig. 103 South Africa market estimates and forecasts, 2018 - 2030

Fig. 104 Israel

Fig. 105 Israel Arabia market estimates and forecasts, 2018 - 2030

Fig. 106 Market share of key market players- Legal marijuana market

Market Segmentation

- Legal Marijuana Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Legal Marijuana Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Flower

- Oil and Tinctures

- Legal Marijuana Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- North America Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- U.S.

- U.S. Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- U.S. Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- U.S. Legal Marijuana Market, By Application

- Canada

- Canada Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Canada Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Canada Legal Marijuana Market, By Application

- North America Legal Marijuana Market, By Application

- Europe

- Europe Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Europe Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- UK

- UK Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- UK Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- UK Legal Marijuana Market, By Application

- Germany

- Germany Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Germany Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Germany Legal Marijuana Market, By Application

- Spain

- Spain Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Spain Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Spain Legal Marijuana Market, By Application

- Italy

- Italy Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Italy Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Italy Legal Marijuana Market, By Application

- Netherlands

- Netherlands Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Netherlands Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Netherlands Legal Marijuana Market, By Application

- Croatia

- Croatia Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Croatia Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Croatia Legal Marijuana Market, By Application

- Poland

- Poland Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Poland Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Poland Legal Marijuana Market, By Application

- Czech Republic

- Czech Republic Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Czech Republic Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Czech Republic Legal Marijuana Market, By Application

- Switzerland

- Switzerland Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Switzerland Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Switzerland Legal Marijuana Market, By Application

- Europe Legal Marijuana Market, By Application

- Asia Pacific

- Asia Pacific Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Asia Pacific Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- China

- China Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- China Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- China Legal Marijuana Market, By Application

- India

- India Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- India Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- India Legal Marijuana Market, By Application

- Japan

- Japan Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Japan Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Japan Legal Marijuana Market, By Application

- New Zealand

- New Zealand Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- New Zealand Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- New Zealand Legal Marijuana Market, By Application

- Australia

- Australia Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Australia Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Australia Legal Marijuana Market, By Application

- Thailand

- Thailand Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Thailand Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Thailand Legal Marijuana Market, By Application

- Asia Pacific Legal Marijuana Market, By Application

- Latin America

- Latin America Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Latin America Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Brazil

- Brazil Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Brazil Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Brazil Legal Marijuana Market, By Application

- Mexico

- Mexico Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Mexico Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Mexico Legal Marijuana Market, By Application

- Colombia

- Colombia Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Colombia Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Colombia Legal Marijuana Market, By Application

- Uruguay

- Uruguay Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Uruguay Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Uruguay Legal Marijuana Market, By Application

- Latin America Legal Marijuana Market, By Application

- MEA

- MEA Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- MEA Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Israel

- Israel Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- Israel Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- Israel Legal Marijuana Market, By Application

- South Africa

- South Africa Legal Marijuana Market, By Application

- Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Adult Use

- Medical

- South Africa Legal Marijuana Market, By Product Type

- Flower

- Oil and Tinctures

- South Africa Legal Marijuana Market, By Application

- MEA Legal Marijuana Market, By Application

- North America

Legal Marijuana Market Dynamics

Driver: Growing adoption of medical marijuana for treatment of chronic diseases

In the recent times, the adoption of marijuana for medical purposes is gaining impetus across the world owing to recent legalizations in different countries. Medical marijuana is used for treating the patients suffering from chronic conditions including Alzheimer’s disease, Parkinson’s disease, cancer, arthritis, neurologic problems like anxiety, depression, epilepsy, and others. Thus, widespread applications of medical marijuana have augmented its adoption for treatment of multiple chronic conditions. The rising prevalence of cancer is projected to be one of the factors driving the medical marijuana market over the forecast period. For instance, according to the WHO, cancer is the leading cause of deaths in the world and was responsible for over 10 million deaths in 2020. Moreover, the growing disease burden of chronic pain and increasing requirement of pain management therapies across the world are likely to propel the demand for medical marijuana over the forecast period.

Driver: Impending legalization of marijuana for recreational/adult use

The marijuana industry is gaining momentum due to the increasing usage of marijuana for medical and adult use. Marijuana has only been legalized for medical use in specific countries and is likely to be legalized for adult use as well. With the legalization of marijuana, the adoption of marijuana is projected to further increase with surging medical and adult-use patients and consumers. Furthermore, a shift in patient preference for marijuana from medical to recreational purposes is anticipated owing to easy access and low cost of marijuana after legalization. However, even if the price of legal marijuana is lower than medical marijuana, taxes would be levied on marijuana products after its legalization. Therefore, cultivators are emphasizing on cultivating marijuana in areas that are exempt from taxes. For instance, in the New York, the cultivators are focusing on tribal regions to get exempted from the taxes levied by the government. This is anticipated to lower the overall cost of cultivation of marijuana in the state and cultivators can sell marijuana at lower prices. Lower prices of marijuana are further projected to boost the adoption of marijuana in the market.

Restraint: Lower market access of marijuana due to absence of legalization programs in several Asian and African countries

The Middle Eastern and Asian countries rarely encourage using marijuana, even for medical purposes. The countries in these regions have stringent laws and punishments for those caught or found consuming cannabis and are not in favor of lessening these laws or decriminalizing them. Thus, very few countries have legalized the adoption of marijuana for medical purpose. For instance, drug regulations in Indonesia also include life imprisonment, USD 1.2 million fine, and even a death penalty for those consuming illegal drugs including marijuana. This is expected to hamper the medical marijuana market growth in these regions.

What Does This Report Include?

This section will provide insights into the contents included in this lehal marijuana market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Legal marijuana market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Legal marijuana market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

Research Methodology

A three-pronged approach was followed for deducing the legal marijuana market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for legal marijuana market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of legal marijuana market data depending on the type of information we were trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Legal Marijuana Market Categorization:

The legal marijuana market was categorized into three segments, namely product type (Flower, Oil and Tinctures), application (Medical, Adult Use), and region (North America, Europe, Asia Pacific, Latin America, and Africa).

Segment Market Methodology:

The legal marijuana market was segmented into product type, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The legal marijuana market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-one countries, namely, the U.S.; Canada; the UK; Germany; Italy; Netherlands; Croatia; Poland; Czech Republic; Switzerland; Spain; China; Japan; India; Thailand; New Zealand; Australia; Uruguay; Colombia; Mexico; Brazil.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Legal marijuana market companies & financials:

The legal marijuana market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Canopy Growth Corporation -Canopy Growth Corporation produces and distributes medical cannabis. The company operates through its subsidiaries that are involved in production, packaging, and distribution of marijuana. The product offerings of Canopy include dried flowers, oils, concentrates, soft gel capsules, and hemp. The 3 key brands of the company include Tweed, Inc.; Bedrocan Canada; and Mettrum (now known as Spectrum Cannabis). The company sells and promotes its products through Tweed Main Street.

-

Aphria, Inc. -Aphria, Inc. is involved in the production and selling of medical marijuana and its derivatives, including cannabis oil. The company also provides consultation to patients and physicians. The company delivers its products through its website and e-commerce channel. It markets sativa, indica, and hybrid varieties of marijuana. Broken Coast Cannabis Ltd.; Broken Coast Cannabis Ltd.; FL-Group; ASG Pharma Ltd.; Cannan Growers, Inc.; and Pure Natures Wellness, Inc. are some of the key subsidiaries of the company.

-

Aurora Cannabis - Aurora Cannabis produces and distributes dried cannabis and cannabis oil. The company provides variety of cannabis strains with different THC and CBD levels. Aurora Cannabis offers indica, sativa, and hybrid varieties of cannabis. It also provides patients consultation and information on cannabis. The company is vertically integrated, as it is involved in cultivation, development, research, and supply of cannabis to retailers.

-

Wayland Group Corp- Wayland Group Corp. previously known as Maricann, Inc., is a producer and distributor of medical marijuana. The company’s product portfolio comprises cannabis oil & buds. Wayland also supplies marijuana plants for home growers. The company caters to the Canadian medical marijuana market, however, has presence in other emerging medical marijuana markets, including Germany, as well.

-

Tilray- Tilray is a privately held company involved in cultivation, processing, and marketing of medical marijuana. The company has GMP certified unit that processes cannabis flowers and other extracts. The company’s customer base includes pharmacies, physicians, patients, hospitals, government, and researchers. It was the first producer licensed to legally export cannabis products from North America to the South America, Australia, European Union, and New Zealand. The product portfolio of Tilray includes whole marijuana flower, ground marijuana, and marijuana drops & capsules. The company also sells accessories like vaporizers and storage containers.

-

GW Pharmaceuticals, PLC. - GW Pharmaceuticals, plc is a UK based biopharmaceutical company focused on developing, discovering, and commercializing novel therapeutics based on marijuana for a variety of diseases. The company has received 'Orphan Drug Designation' from the U.S. FDA for its product Epidiolex for treating Dravet syndrome, Lennox- Gastaut syndrome, Infantile Spasms (IS), and Tuberous Sclerosis Complex. Furthermore, the product has also received Fast Track Designation from the FDA, and Orphan Designation from the European Medicines Agency for Epidiolex.

-

United Cannabis Corporation - United Cannabis Corporation is a biotechnology company involved in the development of marijuana-based medicinal products. The company is vertically integrated as it is actively involved in the production, manufacturing, marketing, and distribution of medical marijuana and its infused products in the US market. The company has partnered with several local entrepreneurs, businessmen, and government agencies for widening its marijuana product portfolio.

-

Tikun Olam, Ltd. - Tikun Olam Ltd is a privately held producer of medical cannabis in Israel. It is the first and the largest supplier of medical marijuana in Israel and is globally known as the pioneer of modern medical cannabis. The company is vertically integrated as it is involved in activities ranging from cultivation to administration of marijuana. The company has established a notable presence in countries such as the U.S., the UK, Canada, and Australia.

-

Cannabis Sativa, Inc.- Cannabis Sativa, Inc. is a vertically integrated company involved in the production, research, development, and licensing of products including cannabis formulas, topicals, strains, recipes, edibles, and drug delivery systems. It produces and develops marijuana products through joint ventures with companies licensed under state regulations. Moreover, the company is also engaged in the development of third-party strains of the cannabis plant. It operates in the market through its subsidiary named Wild Earth Naturals, Inc.

-

Organigram Holdings, Inc. - Organigram Holdings, Inc. markets its products through its subsidiary—Organigram, Inc. The company produces and markets medical cannabis within Canada. It offers a broad portfolio of cannabis oils. Some of the key brands of the company include Banook, Rossignol, Shubie, and Utopia. Organigram is a licensed medical cannabis producer regulated by the Marihuana Medical Access Regulation (MMAR) of the government of Canada.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Legal Marijuana Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2016 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Legal Marijuana Market Report Assumptions:

-